Irs Casino Tax Refund

- Irs Tax Refund Phone Number

- Irs Tax Refund Tracker

- Irs Tax Refund Check Sample

- Irs Casino Tax Refund Status

- Gambling US Taxes Refund Casino Tax Refund is tax recovery service for Canadians made simple and straightforward. Contact us today: 1.844.829.3678.

- When the casino taxes your jackpot they calculate 30% of the jackpot amount, not the amount you were ahead at the end of your gambling activity. You can ask the IRS to factor in the amount you spent gambling, to reduce the amount of tax you'd owe and produce a refund for the difference.

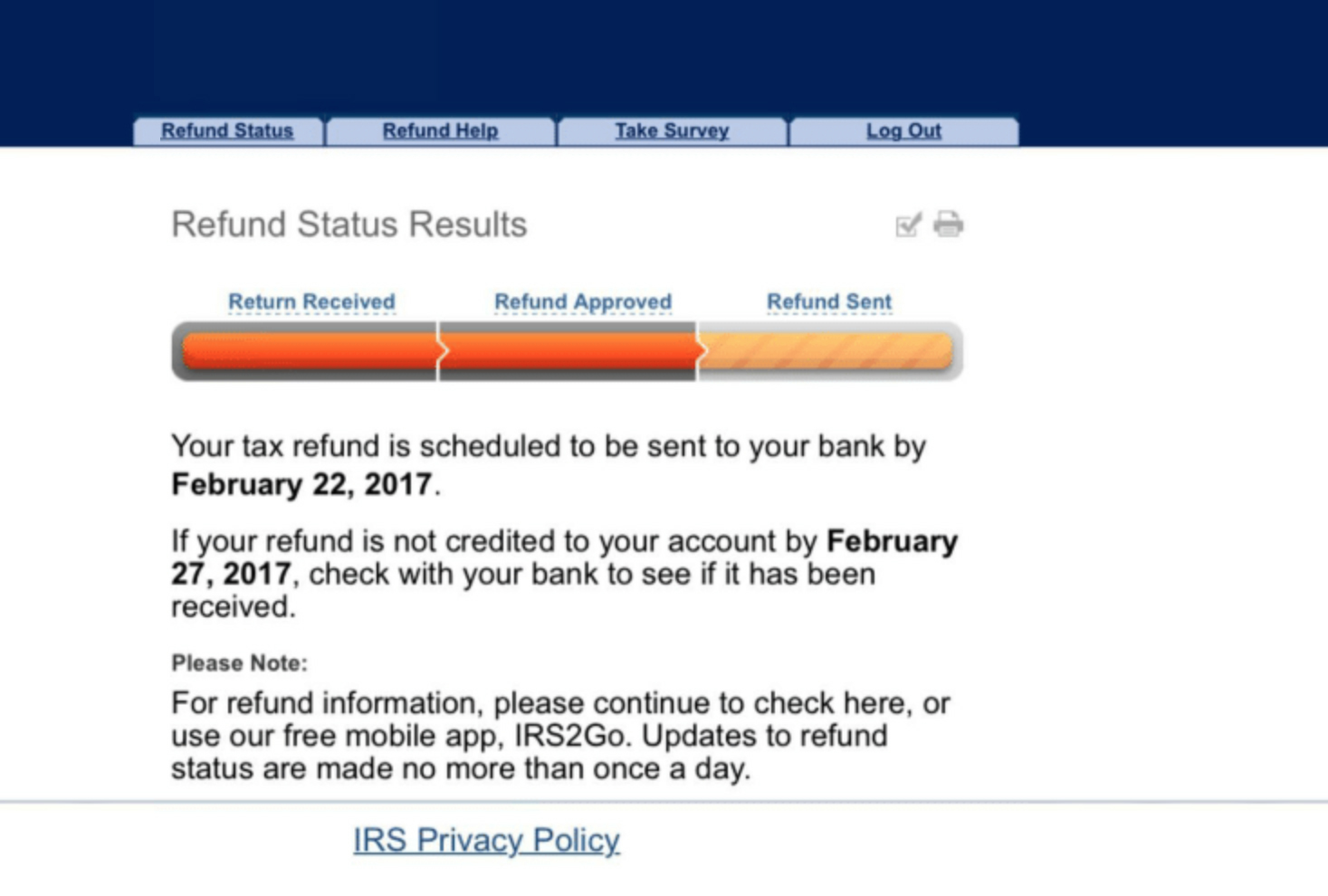

- Refund Status Thank you for using the IRS web site to obtain your tax information. For security reasons, we recommend that you close your browser after you have finished accessing Your Refund Status.

In total, the falsified returns claimed $3,936,000 in federal tax refunds stemming from casino withholdings. The IRS paid Watsey and the other unnamed conspirators $1,292,720 before investigators.

Most gamblers hope to win money when they visit a casino, but many fail to think about the taxes they would have to pay on their winnings. Meet George and Frank, two American friends who spend a weekend gambling at the Las Vegas Bellagio. George wins $200 playing video roulette. Frank wins $1500 on a quarter slot machine (Play here). Both men make some significant financial mistakes that could get them into trouble with the IRS.

Mistake # 1 - Frank Fails to Pay Taxes on His Winnings

Before leaving the casino, Bellagio officials ask Frank to supply his Social Security number and fill out a W - 2G stating his $1500 winnings. When tax time rolls around, Frank forgets about the W – 2G and does not report the $1500 on his tax forms.

Could Frank Get in Trouble?

If Frank gets audited, he could indeed get in trouble with the IRS for failing to report his gambling income. Federal law mandates that slot machine winnings over $1200 must be reported to the IRS. The law also requires horse racing winnings over $600 and keno (click here) winnings over $1500 to be reported. Frank's legal obligation does not end with the W - 2G he filled out at the casino; he must also claim his winnings on Line 21 of his 1040. Failing to do this could result in stern penalties from the IRS.

What About George?

Bellagio officials did not ask George to fill out a W – 2G because his $200 earnings fell below the IRS threshold. Technically, however, he is supposed to claim his $200 winnings on Line 21 of his 1040 just like Frank. Unlike Frank, George stands little chance of getting caught if he fails to do this because there is no paper trail documenting his jackpot (read more). The only punishment George is likely to suffer is the discomfort of a guilty conscience.

If your winnings surpass the predetermined threshold, casino proprietors are required by law to have you fill out a W – 2G which reports your extra income. If you fail to submit this information to the IRS at tax time, government officials could catch a whiff of your paper trail and come after you. If your casino winnings do not surpass the predetermined threshold, you are still required by law to report the money, but without written evidence, the IRS stands little chance of catching you in your dishonesty.

Mistake # 2 - Frank Itemizes His $4000 Gambling Loss and Cheats Himself Out of the $5,950 Standard Deduction

Frank carefully records his losses at the Bellagio in a small notebook he keeps in his pocket. At the end of the weekend, he calculates a $4000 loss. When tax time rolls around, Frank itemizes this $4000 loss and feels like a tax-savvy gambling superstar. Unfortunately, the $4000 is Frank's only itemized deduction for the year and he's actually cheated himself out of a significant chunk of money. If Frank had bothered to do some research, he would have known that the standard deduction in 2012 is $5950. By itemizing only his $4000 loss at the Bellagio, Frank cheated himself out of an additional $1950 deduction.

The Moral of the Story

Irs Tax Refund Phone Number

You can itemize gambling losses on your tax forms in order to recoup some of your lost money, but always find out what the standard deduction is first. You will only come out ahead if your itemized deductions add up to more than the standard deduction.

Mistake # 3 - George Itemizes His Gambling Losses, Which Are Greater Than His Winnings, and Gets in Trouble

After examining the pocketful of ATM receipts he accumulated while at the Bellagio, George realizes that although he won $200, he lost a total of $800. When tax time rolls around, George reports the $800 loss under the miscellaneous deductions section on Schedule A. He also reports his $200 winnings on Line 21 of his 1040. Unfortunately, George does not realize that deducted gambling losses cannot legally exceed gains. He gets audited and fined for failing to comply with this IRS regulation. It is perfectly acceptable to deduct your gambling losses, but you must also report your winnings. On top of that, your claimed losses may not exceed your stated winnings. George can legally claimed a $200 loss because he won $200, but he cannot legally claim an $800 loss in this scenario.

Mistake # 4 - George Fails to Document His Gambling Activities in an IRS-Approved Fashion

George is notified by the IRS that he is being audited and needs to provide legal documentation of the wins and losses he accumulated at the Bellagio. He digs through his suitcase, reassembles his collection of ATM and players card receipts, and submits these slips of paper to the IRS in a manila envelope. IRS officials reject his envelope, stating that this piecemeal form of documentation is unacceptable.

Conclusions

It is wise to track your casino expenditures, but saved receipts are not enough in the case of an IRS audit. Wins and losses should be logged in a notebook which includes the location, date, and amount of money won or lost. Game stubs are also acceptable documentation, but ATM and players club receipts are not.

All Americans must report gambling winnings to the IRS, regardless of what state or country they are in when they win. Gambling proprietors are required by law to report guest winnings that exceed certain predetermined amounts to the IRS. If you don't report your winnings and are audited, you could get in trouble.

Citizens are permitted to claim gambling losses on the miscellaneous deductions section in Schedule A, but losses may not exceed winnings. If you're thinking about itemizing gambling losses on your taxes, experiment with different deduction scenarios to see which will give you the biggest benefit.

Finally, keep track of your wins and losses in a detailed notebook. If you do get audited, IRS officials will only accept certain forms of financial documentation.

What Else Might Interest You:

Online Roulette - Some basics for beginnersIrs Tax Refund Tracker

Casino Jack - a new film by George HickenlooperIrs Tax Refund Check Sample

COMMENTS:

By loading and joining the Disqus comments service below, you agree to their privacy policy.